Perpetual swaps* are an ingenious solution to address settlement, financing, and liquidity in a marketplace that does not have quality access to the central bank system of “tradfi”.

Benefits of Funding Rates in Perpetual Swaps

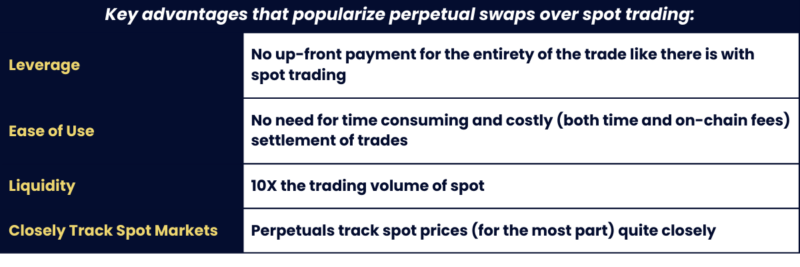

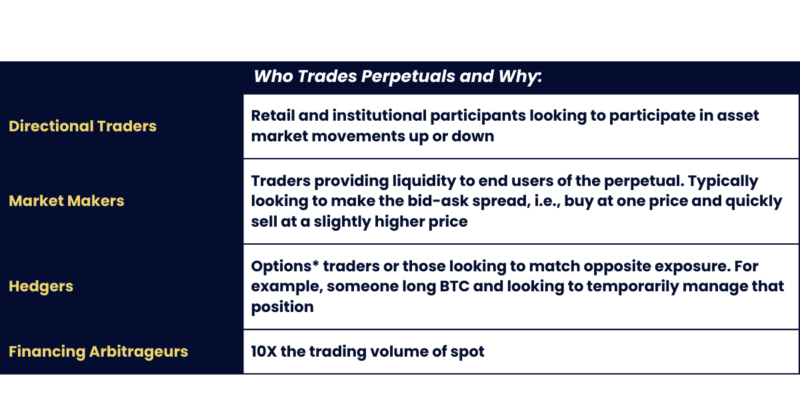

Perpetuals offer several advantages over spot, including leverage and the ability to go short without borrowing. The funding rate mechanism employed by perpetuals can vary by venue type – but they allow perpetuals to solve for missing market infrastructure in cryptocurrency. They also provide an environment for more advanced users to look at opportunities based on arbitraging the cost of leverage. Perpetuals trading volume far exceeds spot trading volume. This is a clear indication that these funding rates that enable perpetuals are playing a critical role in the cryptocurrency markets.

OTC Contracts

Perpetual swaps are prevalent in the crypto markets. The instrument originates from FX markets where participants roll their positions overnight and get credited or charged an interest rate based on the difference between the currencies traded. Regardless of origin, crypto markets have turned these into extremely popular and highly traded derivatives. Consider that CoinMarketCap reports 24-hour volume of $62B for spot BTC trading and CoinGecko reports 24-hour volume for perpetuals of $600B (3/12/2024).

The leverage in a perpetual swaps contract allows a trader to borrow assets – either USD if long or the token if short – when trading. This is provided by the counterparty of the trade. There are two types of perpetual swaps: exchange-traded and OTC. Here we will explain how leverage and funding work on each of these venue types. Because of the embedded leverage in derivatives, professional traders are always comparing the cost of that leverage across markets. Alternatives include other derivatives, spot transactions, USD financing, and coin borrowing.

An exchange, whether centralized or decentralized, provides a marketplace for buyers and sellers to transact. It relies on third parties to provide the liquidity: market makers and other traders. Exchanges have devised a clever and effective mechanism for assessing the cost of the leverage. The goal for the perpetual is to match the spot price of the underlying, e.g., BTC. The mechanism imposes a cost, the funding rate, proportional to the distance that the price of the perpetual is from the index.

For example, let’s suppose that spot bitcoin is trading $63,000 and the perpetual is trading $63,025. Buyers have pushed the price of the perpetual to $25 over the spot index. The exchange imposes a cost to the buyer of $25 and credits that to the seller in the form of the funding rate. It is meant to get the economics of the trade so that the contract is, essentially, back to the spot price via an interest rate that is functionally equivalent to the $25. The premium or discount to spot pricing varies over time, so the funding rate does not correspond to a specific buyer or seller’s transaction price. As a technical note, exchanges typically use an index of spot prices incorporating multiple trading venues.

A trader would pay over the cost of transacting in the spot market if it were advantageous to do so. If it costs 10% to borrow USD and the funding rate cost only 5%, then a trader could purchase the perpetual contract and save financing costs. It is true that not everyone needs to borrow money for spot transactions, however, if the prevailing interest rates are above 5% then a trader could invest at 10% and buy the perpetual.

OTC contracts work differently. An OTC desk stands ready to buy or sell the perpetual swap and is the counterparty of every trade. Funding rates are determined based on client positioning, OTC desk funding and borrowing costs, and prevailing interest rates. The key differences are that OTC desks will typically avoid extreme spikes in interest rates associated with exchange-traded perpetuals and offer more flexibility in dealing with funding costs as compared with exchanges.

To learn more, contact BlockFills

*The information in this document is not to be construed as an offer to sell or a solicitation or an offer to buy contracts for difference (CFD), cryptocurrencies, futures, foreign exchange, or options on the aforementioned. All information contained herein is believed to be accurate, Reliz Ltd makes no representation as to the accuracy or completeness of any data, statistics, studies, or opinions expressed and it should not be relied upon as such. The risks of trading can be substantial. Each investor must consider whether this is a suitable investment. Before trading one should be aware that with potential profits there is also potentialthe potential for losses that may be very large. Contracts for difference (CFD), cryptocurrencies, futures, foreign exchange, and options trading isare highly speculative in nature and involves substantial risk of loss and isare not appropriate for all investors. Those acting on this information are responsible for their own actions. Past performance is not indicative of future results.

*Derivative Products available to Qualified Counterparties Only. For US Persons, client is an Eligible Contract Participant (“ECP”) as defined in Section 1a(18) of the Commodity Exchange Act and related guidance. Non-US Persons must qualify as an Eligible Professional Client.