x

BlockFills has collaborated with CoinDesk Indices, to introduce the BlockFills CoinDesk 20 Options Market bringing professional liquidity to the CoinDesk 20 Index (CD20). As the digital asset markets mature, BlockFills has seen market participants demand a foundational reference index to measure performance for trading and investing needs.

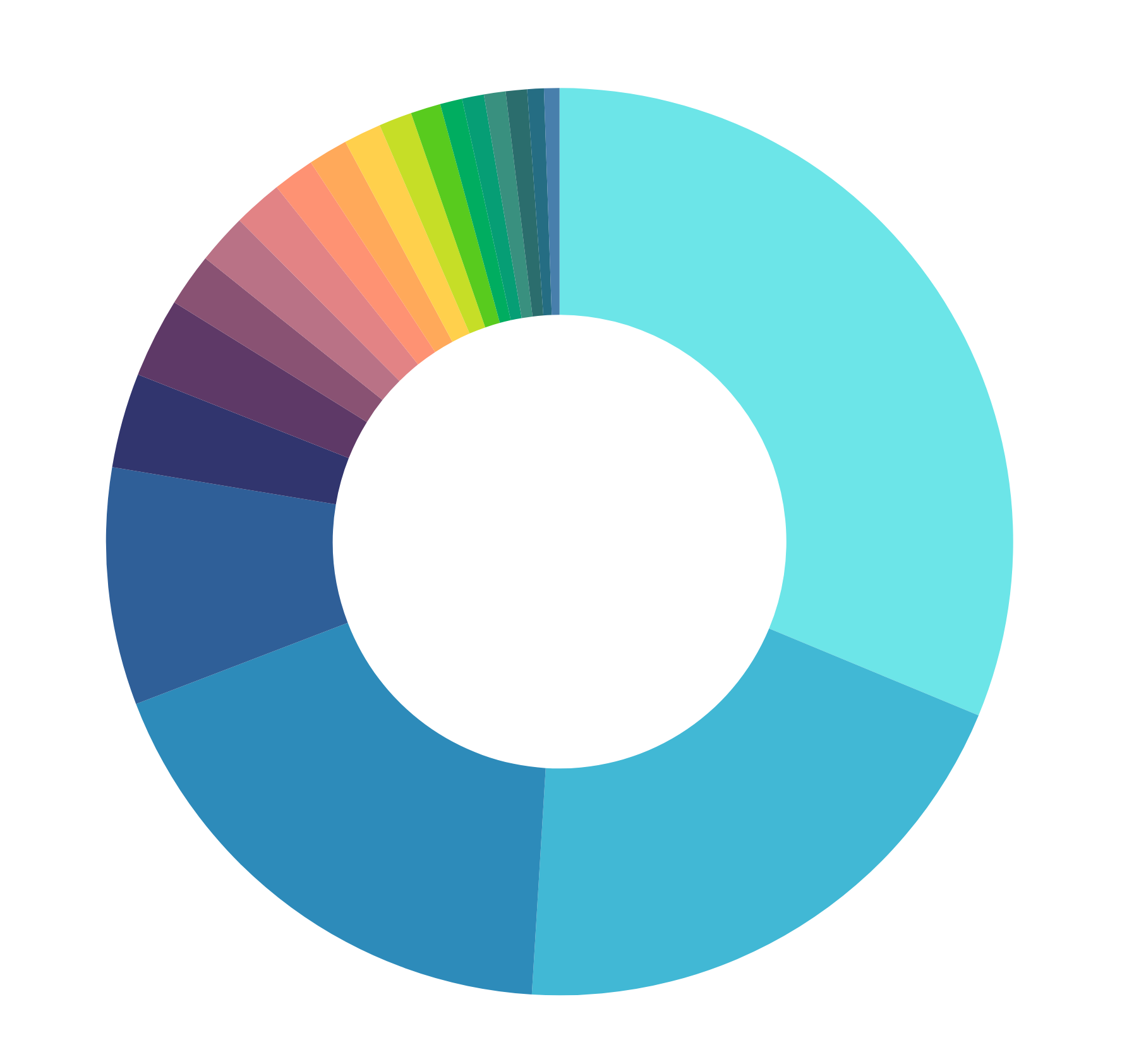

The CoinDesk 20 Index (CD20) measures the performance of leading digital assets and applies a capped market capitalization weighted methodology to ensure portfolio diversification.

The CoinDesk 20 Index aims to provide a clear and objective view of the cryptocurrency landscape, making it a valuable tool for investors seeking exposure to a broad range of digital assets.